Second home mortgage how much can i borrow

The average homeowner puts about 10 down when they buy. A home-equity loan also known as an equity loan a home-equity installment loan or a second mortgage is a type of consumer debt.

Pin On Real Estate

15000 750000 up to 1 million for properties in California Up to 30 years.

. Or 4 times your joint income if youre applying for a mortgage. If your second property is considered a personal residence you can deduct mortgage interest in the same way you would on your primary homeup to 750000 if you are single or married filing. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan.

It allows home owners to borrow against. The loan is secured on the borrowers property through a process. This mortgage finances the entire propertys cost which makes an appealing option.

77600 x 4 310400. Most lenders ideally like to see a down payment of around 20 of the price of the homePutting 20 down on your home eliminates the need for private mortgage insurance PMI requirements though may lenders allow buyers to purchase their home with smaller down payments. The general rule is that you can afford a mortgage that is 2x to 25x your gross income.

How much deposit for a second home. This means that you can borrow more money with a second mortgage than with other types of loans especially if youve been making payments on your loan for a long time. Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Please call us to discuss. We do not offer 95 LTV residential mortgages on second homes.

That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. The minimum mortgage deposit you would need on a second home would be 10 ie. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage.

You cannot use a VA loan for second home purchases but you can use it for a second primary residence. Mortgage calculators can be useful to get a rough idea of your total borrowing but keep in mind that they are unable to take into account your personal circumstances and therefore there may be additional factors that affect the actual amount you can borrow. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any.

Gifts or loans from relatives and programs like an 801010 combination loan can help you avoid PMI. Find out what you can borrow. How long will I live in this home.

This mortgage calculator will show how much you can afford. Total monthly mortgage payments are typically made up of four components. The longer term will provide a more affordable monthly.

A 90 LTV mortgage. In mortgage lending the term second home typically refers to a vacation home like a beach getaway. LENDER APR LOAN AMOUNT RANGE LOAN TERMS MAX LTV.

How much can I borrow. Pros Of A Second Mortgage. If youre looking for a buy to let second mortgage youll need a minimum 25 deposit or 35 if the property is a new build house or flat.

You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit. Fortunately KeyBank lets you borrow up to 90 percent of your homes value in a first and second mortgage if you qualify. You can get a 025 percent rate discount if you have a KeyBank.

Home equity loan rates can vary depending on the lender and home equity product you choose. Start here to learn about second home mortgage requirements and interest rates. The VA will allow you to borrow up to four times the amount of your available entitlement for a new loan.

However as a drawback expect it to come with a much higher interest rate. Second mortgages can mean high loan amounts. In general the maximum you can borrow is up to 80 of the available equity or the current value of your home minus what you owe on the mortgage otherwise known as loan-to-value ratio LTV.

How Much Mortgage Can I Afford if My Income Is 60000. At 60000 thats a 120000 to 150000 mortgage. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

Some lenders allow you to take up to 90 of your homes equity in a second mortgage. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. Principal interest taxes and.

Refinancing your home getting a second mortgage taking out a home equity loan or getting a HELOC are common ways people use a home as collateral for home equity financing. Borrowers who have good credit could borrow up to 80 of their homes current value with a. 801010 loans consist of a first mortgage 80 and a second mortgage 10 that total 90 of the purchase price and a 10 down payment.

You can deduct the interest and property taxes You can deduct the mortgage interest for both your primary residence and second home up to 750000 total or 375000 if married filing. Please get in touch over the phone or visit us in branch. For example home equity loan rates ranged from 51 percent to 589 percent in 2020 while HELOC rates.

Generally as long as you stay under that credit limit you can borrow as much as you need any time you need it by writing a check or using a credit card connected. The usual rule of thumb is that you can afford a mortgage two to 25 times your income.

Getting A Second Mortgage Td Canada Trust

U Haul Home Renovation Loan Moving Truck New Home Buyer

Getting A Second Mortgage Td Canada Trust

Getting A Second Mortgage Td Canada Trust

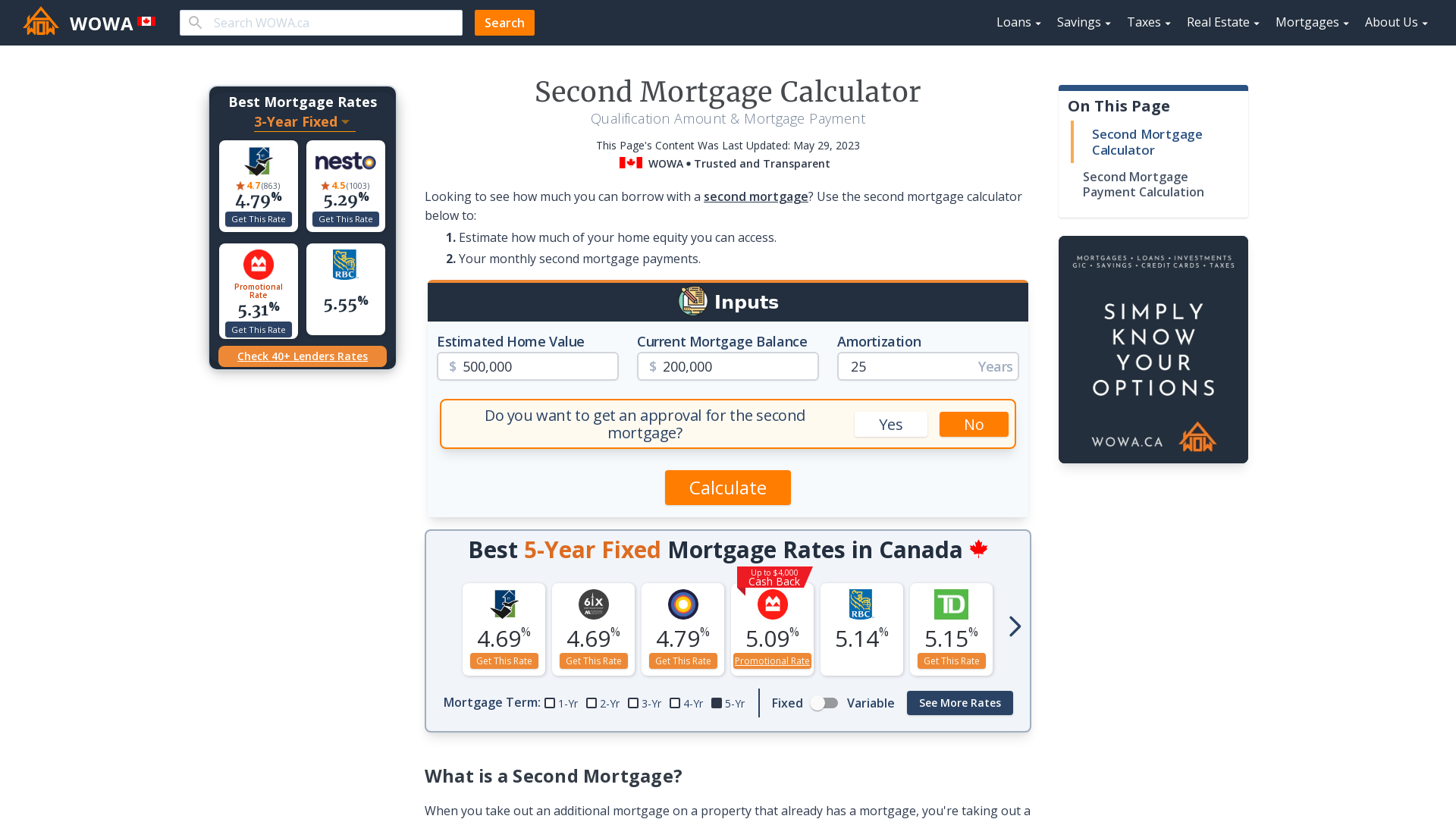

Second Mortgage Calculator Qualification Payment Wowa Ca

What Is Mortgage Insurance We Ve Got The Answers On Our Blog Mortgage Mortgage Tips Private Mortgage Insurance

Heloc Infographic Heloc Commerce Bank Mortgage Advice

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

Interested In Borrowing Against Your Home S Available Equity To Pay For Other Expenses The Good News Is You Have Ch Home Equity Line Of Credit Mortgage Payoff

1

Another Monday Another Mortgage Glossary Term Let Us Tell You A Little Bit About Appreciation Appreciati Home Equity Line Of Credit Mortgage Interest Rates

12 Things Canadians Don T Know About Second Mortgages Canadian Mortgages Inc

The Ultimate Real Estate Loan Guide Infographic Health Mortgage Payment Calculator Cleveland Clinic

Vintage House Plans 1960s Cottages And Second Homes Vacation House Plans Vintage House Plans Vintage House Plans 1960s

Getting A Second Mortgage Td Canada Trust

Mortgage Santander Buying Your First Home How To Plan First Home

1